Katera zavarovanja potrebujem?

Vita zavaruje tvoje zdravje in življenje, saj je to tvoje največje bogastvo.

Glede na situacijo, v kateri se trenutno nahajaš,

ti predlagamo najbolj primerna zavarovanja zate.

Katero zavarovanje naj izberem?

Za lažjo odločitev na hitrem pregledu preveri naša zavarovanja po glavnih značilnostih. Izberi koga želiš zavarovati, zavarovanje glede na starost ter vrsto zavarovanja, naj bo to zdravstveno, življenjsko ali naložbeno življenjsko zavarovanje.

Prikaži zavarovanjaIzjave naših zavarovancev

Zavarovanje je investicija v miren spanec. Preberi, kaj o zavarovanju menijo naši zavarovanci:

Novost: digitalna poslovalnica e.VITA

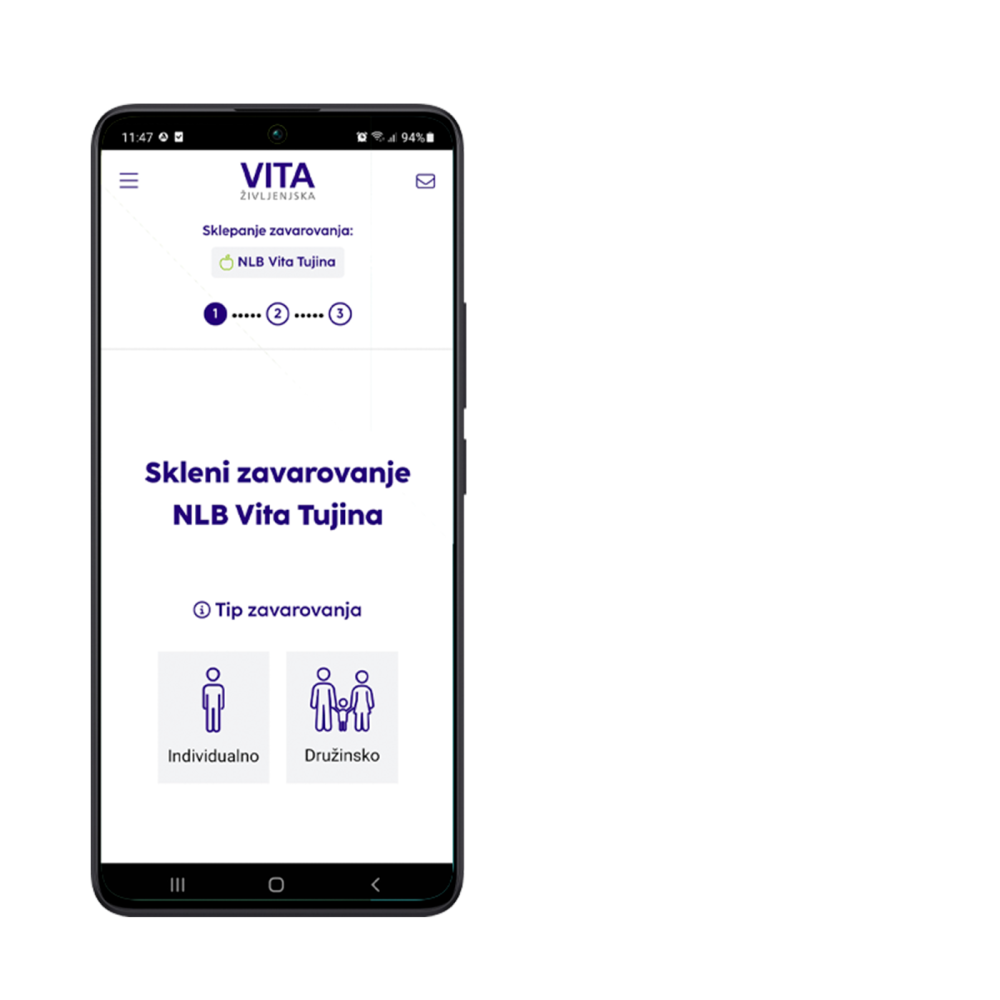

Digitalna poslovalnica e.VITA je spletna in mobilna poslovalnica Zavarovalnice Vita, v kateri lahko:

- enostavno pregleduješ in upravljaš svoja zavarovanja

- sklepaš nova zavarovanja zase in za svojo družino

- hitro in enostavno prijaviš zavarovalni primer

- stopiš v direktni kontakt z nami

Vitine novosti

Bodi na tekočem z zavarovanji in varčevanji. Vpiši svoj elektronski naslov in obveščali te bomo o novostih v naši ponudbi, akcijah in ugodnostih.

Kako prijavim zavarovalni primer?

- Če želiš prijaviti zavarovalni primer, obišči digitalno poslovalnico e.VITA ali najbližjo NLB Poslovalnico.

- Sporoči osnovne osebne podatke zavarovanca in kratek opis problema.

- Za vse ostalo poskrbimo mi, zato si lahko brez skrbi.

Potrebuješ pomoč? Pokliči na 01 476 58 20 ali nam piši na info@zav-vita.si.

Potrebuješ posvet?

Nisi prepričan/-a, katero je najboljše zavarovanje zate? Za vsa vprašanja smo ti na voljo.